Risk, Finance and Compliance

- Home

- Risk, Finance and Compliance

- MODULE C

Risk, Finance and Compliance

- IT governance and cyber security

- Anti-money laundering and counter-terrorism financing

- Risk management

- Finance for non-finance directors

- Corporate finance

IT Governance & Cyber Security

- Ensuring robust IT governance frameworks

- Addressing emerging cybersecurity threats and risks

- Building resilient IT systems and protocols

- Director responsibilities in managing

- cybersecurity

- Establishing a cyber-risk management plan

- Conducting regular cybersecurity training and assessments

- Collaboration with IT departments to manage risks

- Regulatory compliance related to data privacy and security

Anti-Money Laundering & Counter-Terrorism Financing

- Understanding AML and CTF regulations

- Risk management strategies for preventing money laundering

- Best practices for board oversight of AML/CTF activities

- Establishing compliance programs for AML & CTF

- Role of directors in anti-money laundering efforts

- Risk-based approaches to AML/CTF

- Monitoring and reporting suspicious activities

- Collaborating with regulators to ensure compliance

Finance for non-Finance Directors

- Basic financial literacy for directors

- Financial decision-making and risk assessment

- Financial performance indicators and metrics

- Cost management and profitability analysis

- Board oversight of financial risks and opportunities

- Strategic use of financial resources

- Collaborating with CFOs to ensure financial health

- Understanding key financial statements (balance sheet, P&L, cash flow)

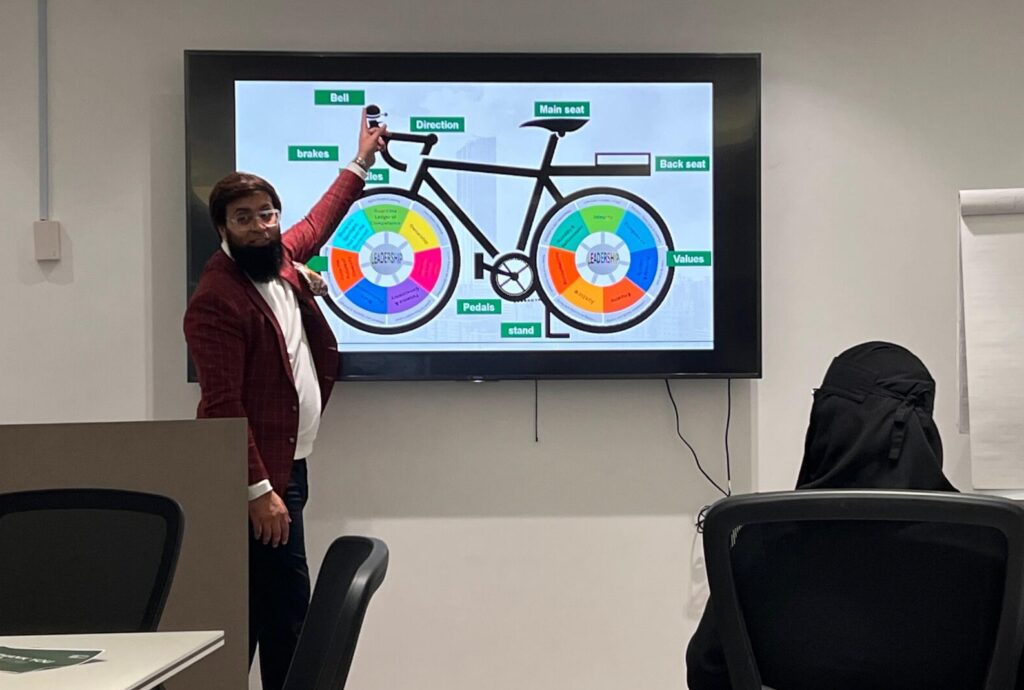

Risk Management

- Identifying and assessing corporate risks

- Enhancing the risk management framework

- Strategies for mitigating and managing risks

- Role of the board in risk oversight

- Ensuring risk management is integrated with business strategy

- Conducting regular risk assessments and audits

- Monitoring and adjusting risk management strategies

- Key risks facing the organization (e.g. operational, financial, reputational)

Corporate Finance

- Understanding corporate finance principles

- Managing capital structure and funding sources

- Corporate valuation methods and strategies

- Managing mergers, acquisitions, and divestitures

- Financing strategies for growth and innovation

- Risk assessment in corporate finance decisions

- Managing financial performance and shareholder value